How to Buy Uniswap (UNI) in 2024

Uniswap is the most popular decentralized exchange (DEX) in the world, with almost half a trillion US dollars in trading volume to date according to the Uniswap website. According to the latest figures from DeFi Llama, Uniswap eclipses other exchanges with $5.3 billion in total value locked (TVL) vs. $2 billion for the next highest exchange, and likewise with over $11.2 billion in weekly trading volume compared to $6 billion from the next exchange on the list.

All of that activity makes the native token, UNI, a hot commodity. This article will explore what UNI is, why people are buying it, the risks involved, and how you to buy UNI in 2024.

Contents

- What is Uniswap (UNI) Token?

- What is the Risk of Buying Uniswap (UNI) Tokens?

- How to Buy Uniswap (UNI) Tokens on a Centralized Exchange

- How to Buy Uniswap (UNI) Tokens on Uniswap

- Cash Out Web3 Instantly With Grineo

What is UNI Token?

UNI token is the native cryptocurrency of the Uniswap platform and it’s used to vote on governance and incentivise liquidity provision. Because Uniswap is a decentralized exchange, it does not work with institutional market makers or liquidity providers. All trading is automated, and all of the platform’s liquidity is provided by the community. People stake pairs of ERC20 tokens including as ETH, USDT, or UNI itself.

For example, a user could deposit an equal amount of ETH and USDT or ETH and LINK to Uniswap’s liquidity pool, thus ensuring that people trying to trade these tokens have a counterparty to trade against. There is a risk of impermanent loss in doing this. For example, if the price of LINK suddenly fell a lot while ETH remained stable, the liquidity provider staking ETH and LINK would lose some of the value of their staked currencies because they are still being used for trading, but now at a less favourable rate of exchange.

On the other hand, users are rewarded with UNI for staking currencies and providing this liquidity, and their UNI tokens can then be used to spend or trade, to stake on Uniswap for more potential rewards, or to vote on governance decisions within the Uniswap ecosystem. These decisions may include which new tokens to list, how much fees are paid out to liquidity providers, scaling solutions, and more.

As such, UNI plays a key role on managing the Uniswap exchange and ensuring that people are incentivised to stake crypto to provide liquidity.

What is the Risk of Buying Uniswap (UNI) Tokens?

UNI, like most cryptocurrencies, is a volatile asset. Prices can change quickly, and there’s no guarantee that your UNI won’t decrease in value. There’s also a user-side risk of losing your funds by misplacing your seed phrase and device, so it’s important to take extra care to store your seed phrase safely. Likewise, never give this phrase to anyone online, and be very skeptical of anyone online trying to discuss or interact with your crypto funds, as scams are common.

Factors that could impact price include poor governance decisions, competition from another DEX, bugs in the smart contract code that Uniswap relies on, and pressure or interference from international financial regulators.

How to Buy Uniswap (UNI) Tokens on a Centralized Exchange

You can easily buy UNI tokens on a centralized exchange like CoinSpot or Coinbase.

Simply:

- Register an account on the exchange. You’ll potentially need to pass KYC verification by providing an ID and address documents, and verification may take a few days.

- Deposit fiat currency via a wire transfer or buy cryptocurrency directly at a higher cost using a debit card.

- On CoinSpot, you can buy UNI tokens with fiat directly. Simply select the amount of UNI you want to buy, or the amount of fiat you want to spend, and confirm the transaction.

That’s all there is to it! If you don’t have an account with an exchange, it may be slower to buy UNI on a centralized exchange vs. on Uniswap due to the KYC waiting times involved. There is also the issue of a lack of privacy when dealing with a centralized exchange, and some people consider centralized exchanges to be less secure than reputable decentralized exchanges like Uniswap.

Having said that, some people prefer to buy UNI on a decentralized exchange like Uniswap.

How to Buy Uniswap (UNI) Tokens on Uniswap

You can buy UNI token a number of ways. If you already have a cryptocurrency like ETH or another ERC20 token (tokens hosted on the Ethereum network), you can pay directly with those tokens. You’ll need a wallet that’s compatible with UNI, such as Trust Wallet or Metamask.

Step 1: Set up your wallet

If you don’t have a wallet already, set up a Metamask wallet or Trust Wallet by downloading the mobile app from the App Store or Google Play. Open the app, follow the instructions including writing down your seed phrase (a recovery password) somewhere safe.

Step 2: Fund your wallet

Now you’ll need to fund your wallet with ETH or ERC20 tokens. You can deposit crypto if you have some already. Alternatively, buy some directly in the app with a credit card, or register an account on a crypto exchange and transfer money there to buy ETH. From there, you’ll need to deposit ETH to Metamask or Trust Wallet.

If you’ve bought crypto on an exchange, copy the deposit address for your ETH wallet within Trust Wallet or Metamask. Go to the wallet on the crypto exchange where you have your ETH. Select Withdraw, and paste your Metamask or Trust Wallet deposit address for ETH.

Select the amount you want to deposit and confirm the trade. There will be a fee for withdrawing the funds.

Step 3: Connect your ETH wallet to Uniswap

Go to Uniswap. Connect your crypto wallet by selecting the Connect Wallet icon at the top of the screen. Make sure that you’re on the right website, and not a fraudulent phishing URL! This is the Uniswap website link where you can find a link to launch the Uniswap app. You can also navigate to Uniswap directly on a Web3 browser like Trust Wallet.

Step 4: Buy UNI with ETH

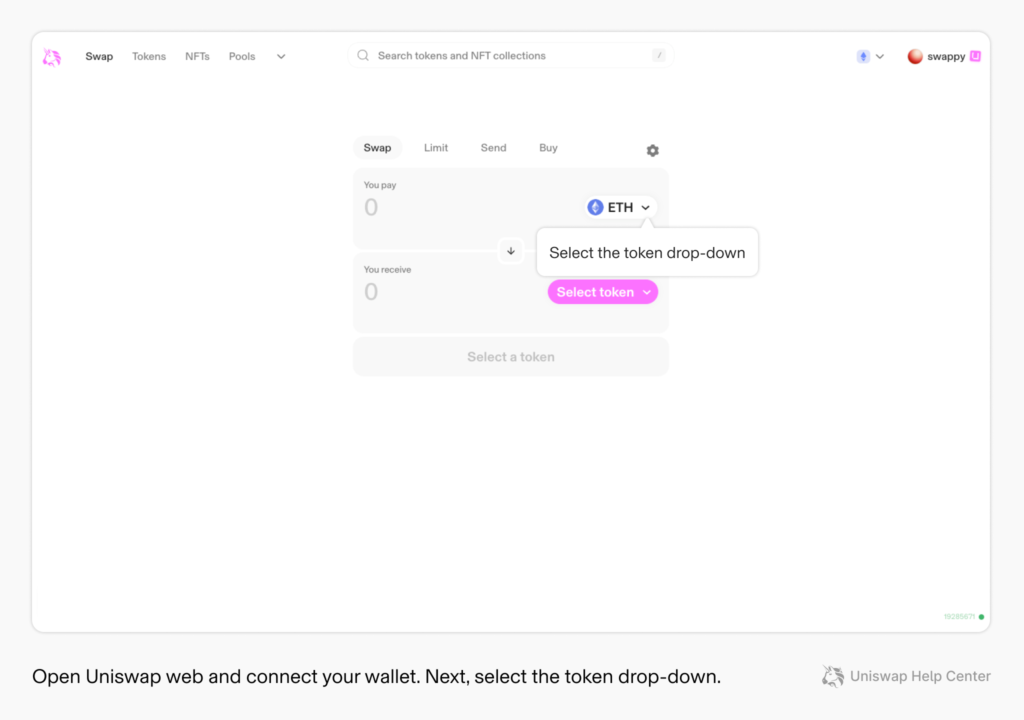

In Uniswap, navigate to the Swap menu at the top of the screen. Select ETH at the top dropdown menu, as shown. At the bottom, select UNI. Enter the amount of UNI you want to receive or the amount of ETH you want to pay, and confirm the trade.

That’s all there is to it! Your UNI tokens will appear in your Trust Wallet or Metamask wallet.

Cash Out Web3 Instantly With Grineo

If you’ve been using Uniswap and you’d like to cash some money out of Web3, you can do that instantly with Grineo. Deposit ETH, BTC, USDT, and USDC for free in your Grineo Wallet and spend or withdraw stablecoins like cash anywhere with the Grineo Card. This is a Visa debit card connected to your stablecoin wallet that works anywhere that accepts Visa, allowing you to tap and spend stablecoins in stores and online or withdraw as cash from any ATM that takes Visa.

Grineo charges just a 1% fee per transaction with no hidden fees, and is available to all residents of Australia over the age of 18.