What is the Best Crypto Card in Australia? Top Australian Crypto Debit Cards

Crypto debit cards are the most convenient way to cash out of crypto and use crypto like money. But while there were few solutions available in the early days, now the crypto space has an ever-growing range to choose from!

While it’s great to see crypto users finally getting the options they deserve, it can be difficult to know where to begin when choosing a crypto card.

With that said, let’s dive into the world of Australian crypto debit cards and see which one is right for you!

What’s a Crypto Debit Card?

A crypto card, or crypto debit card, is a payment card that allows you to pay for goods and services, much like a regular bank card. The difference is that this card will actually allow you to spend cryptocurrencies instead of fiat currencies like the Australian dollar!

While all crypto cards have that much in common, the way that this function is achieved can vary from card to card, as can their added features, supported currencies, and other important factors.

Before we get into individual card features, let’s explore some general categories.

Crypto Debit Cards

Crypto debit cards are essentially regular debit cards that offer support for certain cryptocurrencies. Some of these cards support fiat currencies, whereas some are crypto only. However, all of them are designed to allow you to spend crypto in a store or online.

With physical crypto cards you can tap or insert the card at a paypoint to make a purchase in crypto, or even withdraw crypto as cash from an ATM. Many providers also offer digital cards for online payments only.

Depending on the card issuer, the card may work at a limited selection of merchants or at merchants around the world.

Some cards also offer cashback, staking, or other features. Some of these crypto cards are prepaid cards that the user can top up, like the Grineo card, whereas others are directly connected to your bank account.

Crypto Credit Cards

This is similar to a regular credit card, but with crypto support built in. It typically offers the same features that a crypto debit card does, but allows you to access a line of credit based on your credit rating.

You can make purchases on credit with interest and pay back the loaned sum and interest over time. In some cases, incentives are granted with these cards like rewards points.

Why Should I Get a Crypto Card?

If the benefits of a crypto card aren’t clear, consider this. Typically when someone wants to cash out of crypto, there are quite a few steps involved in the process. They need to send their crypto to an exchange, sell the crypto for fiat currency, and withdraw that fiat currency to their bank account, which can take multiple days. All that simply to spend the value stored in their digital assets!

Each step takes time and costs money due to the fees involved in transferring and swapping cryptocurrencies.

On the other hand, this person could simply use a crypto card. Spending funds is as simple as tapping the card, or even withdrawing crypto as cash from a regular ATM for some cards. To do this, a user simply needs to store crypto in, or transfer crypto to, the wallet connected to their card. The downsides are that crypto cards can charge higher fees than some exchanges, although this is not always the case, and the upside is that they are by far the fastest way to spend crypto like money.

If you earn an income in crypto, or want to cash out some profits, the card allows you to take your crypto on a shopping spree instead of HODLing onto your funds indefinitely.

6 Best Crypto Cards in Australia

Below, you’ll find a list of crypto cards you can get as an Australian resident. Let’s dive right in!

The Grineo Crypto Card

Issued by Visa, the Grineo card is supported at almost every place of business, website, and ATM around the world. This card will be released in Q2 2024 and will function much the same as a Visa card in terms of the end-user payment experience.

Tap or insert the card at a point of sale, enter the details on a website, or use it at an ATM. The Grineo app supports USDT, USDC, BTC, and ETH, and users can exchange these currencies with one another in the app as well. You can also use the card to spend USDC and USDT wherever you go, or withdraw these stablecoins as cash!

Headquartered in Sydney, the card is available only to Australian residents.

Fees

Grineo charges just a 1% commission rate on transactions and ATM withdrawals within Australia, a competitive rate compared to other services. There is no charge for topping up with crypto. Grineo’s crypto exchange fee is just 0.2%.

Supported Cryptos

The app supports 4 cryptocurrencies, while the card supports USD Coin (USDC) and Tether (USDT) stablecoins at the moment, with support for more cryptos in the works.

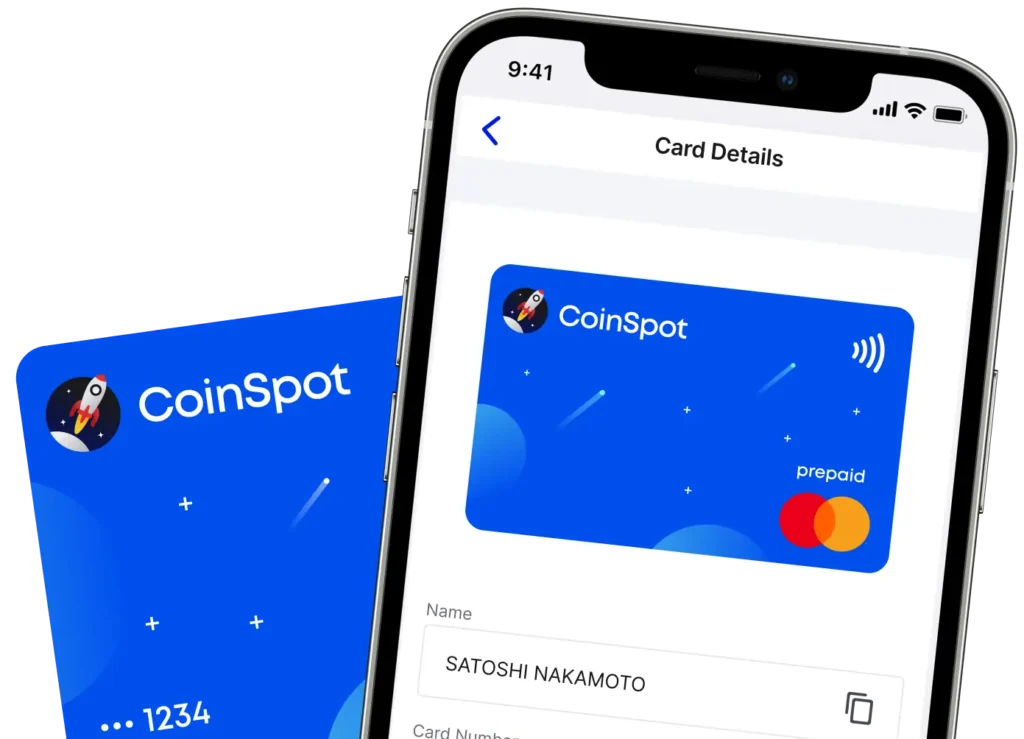

CoinSpot Mastercard

Coinspot is another Australian company offering a crypto card to its users. Like Grineo, Coinspot offers 1% fees on its card. However, no physical card is available, and the card exists only as a digital/virtual crypto card which can be used to make payments online or via a mobile device in stores.

Cash withdrawal of crypto from ATMs is therefore not available. Issued by Mastercard, the card is supported at the vast majority of stores and websites worldwide.

Crypto.com VISA Debit Card

Crypto.com is a popular crypto card service that offers cashback as well as some added rewards at different tiers of service. The metal card tier, for example, allows access to airport lounges. Users can stake the native CRO cryptocurrency for rewards like discounted services from partnered companies, and the card is issued by Visa.

Fees

Crypto.com charges a 1% fee of every top-up to the card, and a 2% ATM withdrawal fee.

Supported Cryptos

The card supports 19 different cryptocurrencies, namely BTC, ETH, LTC, XRP, USDT, USDC, USDP, ADA, CHZ, DAI, DOGE, ENJ, LINK, MANA, MATIC, THETA, UNI, VET, and ZIL.

CoinJar

CoinJar is an Australian crypto exchange and card provider. Mastercard is the issuer, meaning the card is supported worldwide, and CoinJar users can order either physical or digital crypto cards.

CoinJar was founded in 2013, giving the company plenty of time to develop a loyal user base in Australia. The company has a rewards program that lets users earn a portion of their spent fees back in rewards points.

Fees

1% on card transactions in Australia, 1% on ATM withdrawals.

Supported Cryptos

Users can make transactions with 30 cryptocurrencies using the CoinJar Mastercard.

Coinbase Debit Card

Coinbase is one of the biggest exchanges by trading volume in the world, and often the first port of call for new entrants to the market due to its brand awareness and fairly straightforward crypto on-ramp process.A tradeoff of this ease of use and popularity is higher exchange fees than the market average. However, the card fees are more reasonable, and the card is issued by Visa and thus accepted worldwide.

Fees

The card fee is just 0.2% per transaction. However, trading fees vary from 0.4% to 4.5%, and fees for deposits vary from one crypto to another.

Supported Cryptos

The card allows users to spend 10+ different cryptocurrencies.

Wirex Visa Card

Wirex was early to market with its crypto card and remains a popular option today. The team partnered with the Novatti company in 2023 and now offers service to Australian residents. Wirex offers multiple tiers of service with different rewards per tier, much like Crypto.com.

Wirex has integrated with Visa, and as such is accepted by most stores and merchants around the world. The card offers high cashback opportunities.

Fees

ATM fees range from 0 – 2% and it costs 1% to make a transaction with the card. Wirex advertises what it calls a “flexible fee structure,” and other fees may apply at varying rates.

Supported Cryptos

8 cryptocurrencies including BTC and ETH.

Choosing the Right Crypto Card

There are several ways to compare crypto cards. We’ve mostly focused on fees and supported cryptos in this article, but you can also take a look at the rewards programs and perks offered by different cards which can vary greatly. It’s often the case that cards with high cashback rates have many unforeseen conditions.

For example, a card provider may require that your cashback points amount to a certain dollar amount before you can spend them, or may require that you stake their native currency for a fixed period of time to enjoy rewards. It’s always best to look into the information on each card provider’s website before making a decision.

If you’d like to dig into this topic even more, check out our blog post for more information on how to choose a crypto card in Australia.

Sign up to the Grineo card waitlist here!

Frequently Asked Questions

- How do I sign up for a crypto card in Australia?

With Grineo, simply join our waitlist and when the card launches in Q2 of 2024, all you’ll have to do is pass some ID checks and register an account to receive a card.

- How do I top up my prepaid crypto card?

To top up your Grineo card, deposit cryptocurrency to your wallet as shown here.

- What happens if I have an issue with my card?

If you ever have any kind of an issue with your card or your experience with Grineo in general, we’re always here to help. Simply contact Grineo live via our in-app chat or shoot us an email at support@grineopay.com.