The Year in Focus: 2023 Recap of Australia Crypto Industry

It’s been a wild year for crypto users both in Australia and around the world, with highs and lows seen throughout the industry.

This article recaps the latest information on the Australian crypto community as well as what happened in crypto last year and what lies ahead for 2024.

Statistics for Australian Crypto Users in 2023

A Swyftx survey shows that Australian cryptocurrency adoption is extraordinarily high, with almost one in four Australians owning cryptocurrency, and a similar amount aim to enter the crypto industry in the coming year. Over half of the millennial generation in Australia own crypto, making Australia one of the most crypto-native nations in the world.

Not only that, but Australian crypto investors know what they’re doing. 17% of Australian crypto users reported profits of $10,000 or higher in 2023.

Almost one million Australians claim they are likely to enter the crypto market for the very first time in the next 12 months, painting an interesting image of what lies in store for the industry.

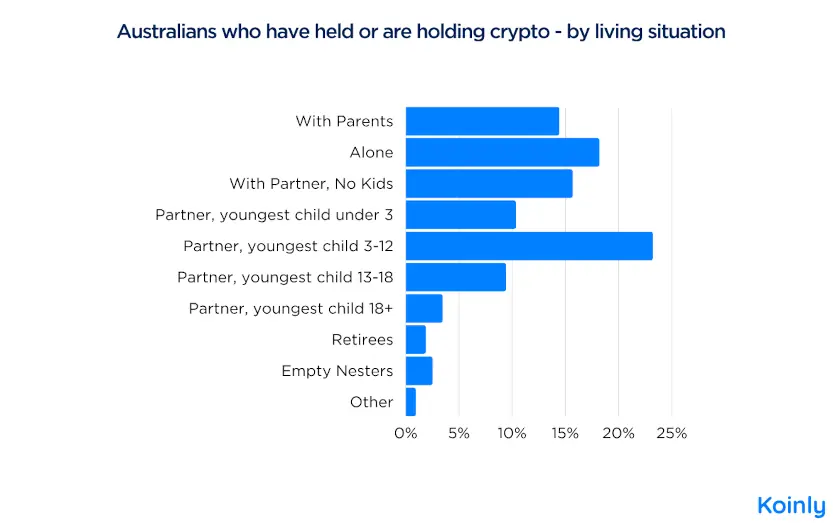

According to Koinly, the age bracket 18-24 is dominated by female crypto users rather than men, and couples with children commonly own crypto.

Interestingly, half of crypto users in Australia earn between $60,000 and $149,999, demonstrating that crypto is not just an industry for the 1% top earners, but something that is more accessible to a wide range of people.

Koinly also had some interesting insights into the NFT industry, finding that over 75% of NFT holders plan to hang on to their NFT assets for the next year without selling. Not only that, but around half of all Australian NFT holders are considering buying more NFTs, perhaps a bullish signal for the somewhat subdued NFT industry.