Bitcoin Halving and Ordinal NFTs: This Time It’s Different

Every four years, the Bitcoin supply is reduced by half, making Bitcoin a scarcer asset over time. At the moment, for each block of Bitcoin transactions that is mined, the miners receive 6.25 BTC. After April 2024, the reward will be 3.125 BTC.

Historically, the halving has been associated with a major price increase on the way. However, Bitcoin’s current market conditions are completely unprecedented for many reasons, all of which can be connected to the Bitcoin Ordinals protocol.

What is the Bitcoin Ordinals Protocol?

Bitcoin Ordinals is a protocol that allows the smallest units of measurement in Bitcoin, the satoshis or SATs, to be assigned with a unique identifier. Each bitcoin contains 100,000,000 satoshis and users can now attach data to any individual satoshi, essentially creating a type of NFT (non-fungible token) for the Bitcoin blockchain.

The protocol was introduced by Casey Rodamor in 2023, allowing people to take a fraction of any bitcoin in the supply and attach art or information to it to sell it as an entirely new type of asset.

Who Are Bitcoin Miners?

Before we dive into the halving information, let’s refresh our knowledge of miners. Bitcoin miners validate the transactions on the Bitcoin network and receive a reward for each block of transactions. This reward is how new bitcoins are mined.

Miners also vote in new updates to the network. They are not a monolith, and must vote because nobody is really in charge of the Bitcoin blockchain. Developers can propose a new update, but the miners need to choose to accept it through a reorg or blockchain fork, essentially creating two versions of the network and only validating transactions on the updated version.

This is important to bear in mind for later on!

Bitcoin has Already Hit an All-Time High Before Halving

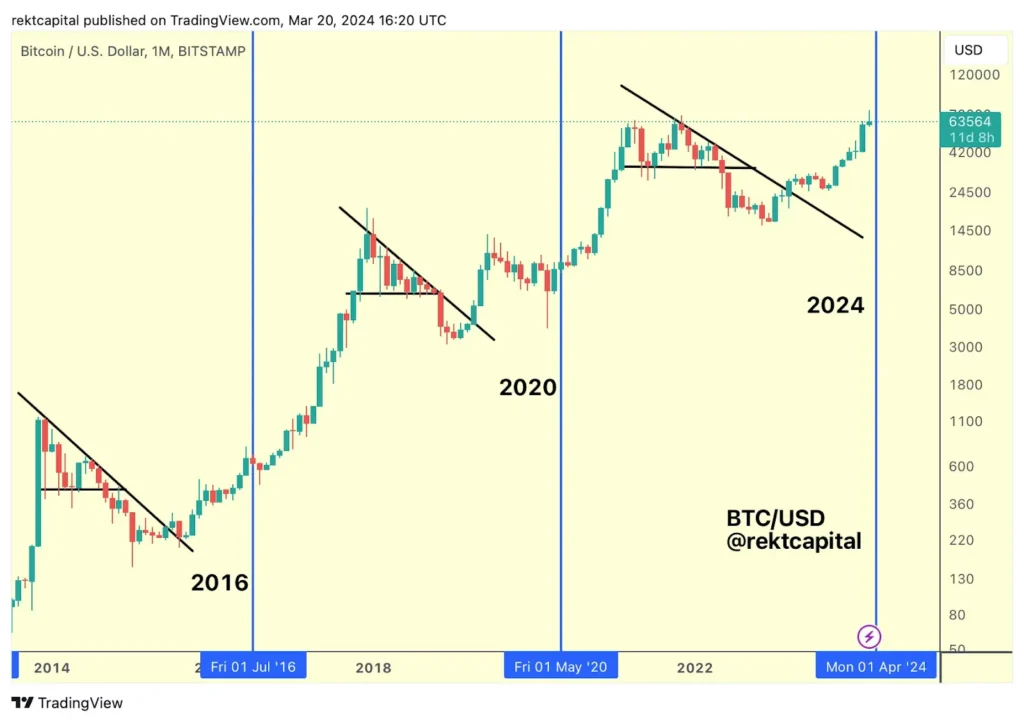

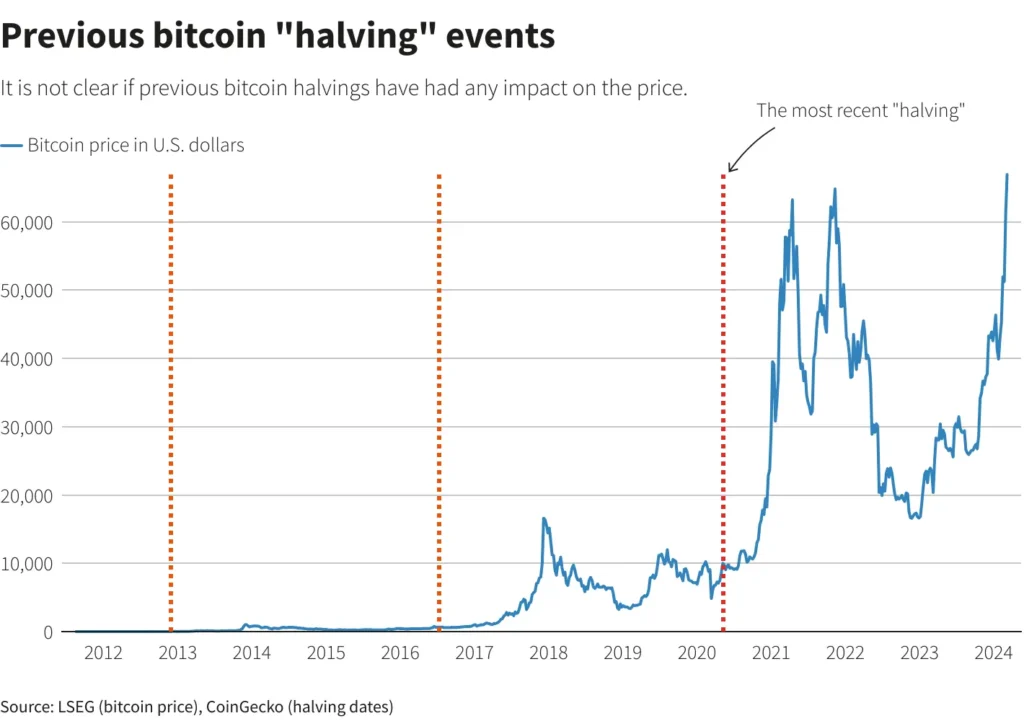

The previous halvings took place in 2020, 2016, and 2012, with price rallying at some point after each one. The halving is an event that the whole market often looks forward to with many investors buying Bitcoin in anticipation of higher prices due to scarcer supply.

Halving chart showing past activity and possible outcomes.

Indeed, the function of the halving is to act as a deflationary measure that encourages price appreciation, the Bitcoin creator’s answer to the inflation seen with fiat currencies.

This time, however, things are a little different. For the first time ever, Bitcoin has already hit an all-time high just months ahead of the halving.

What’s more, network use is way up thanks to Bitcoin Ordinals, and this in turn has increased the fees paid to miners. In fact, this is the first halving where transaction fees are already paying a significant portion of miner revenue.

However, that doesn’t mean the miners aren’t interested in the block rewards! One block in particular has caught their attention.

Most Valuable Block Ever Could Cause a Chain Reorg

It’s entirely possible that the halving itself will be overshadowed by a network reorg or fork that some analysts expect to occur for the halving block.

At the moment, the block reward for each block is 6.25 BTC worth about $630,000 AUD at the time of writing. The halving will occur at block height 840,000, and it’s possible that this block will contain satoshis of particular interest to Bitcoin Ordinals collectors.

Collectors may ascribe particular value to Bitcoin NFTs minted on satoshis mined from the halving block due to their perceived scarcity, perhaps leading to unusual market demand for Ordinals or NFTs tied to this halving event.

The founder of Ordiscan even went so far as to suggest that the miners would attempt a blockchain reorg, a miner-led restructuring of the blockchain, in order to position themselves as the ones to receive the block reward.

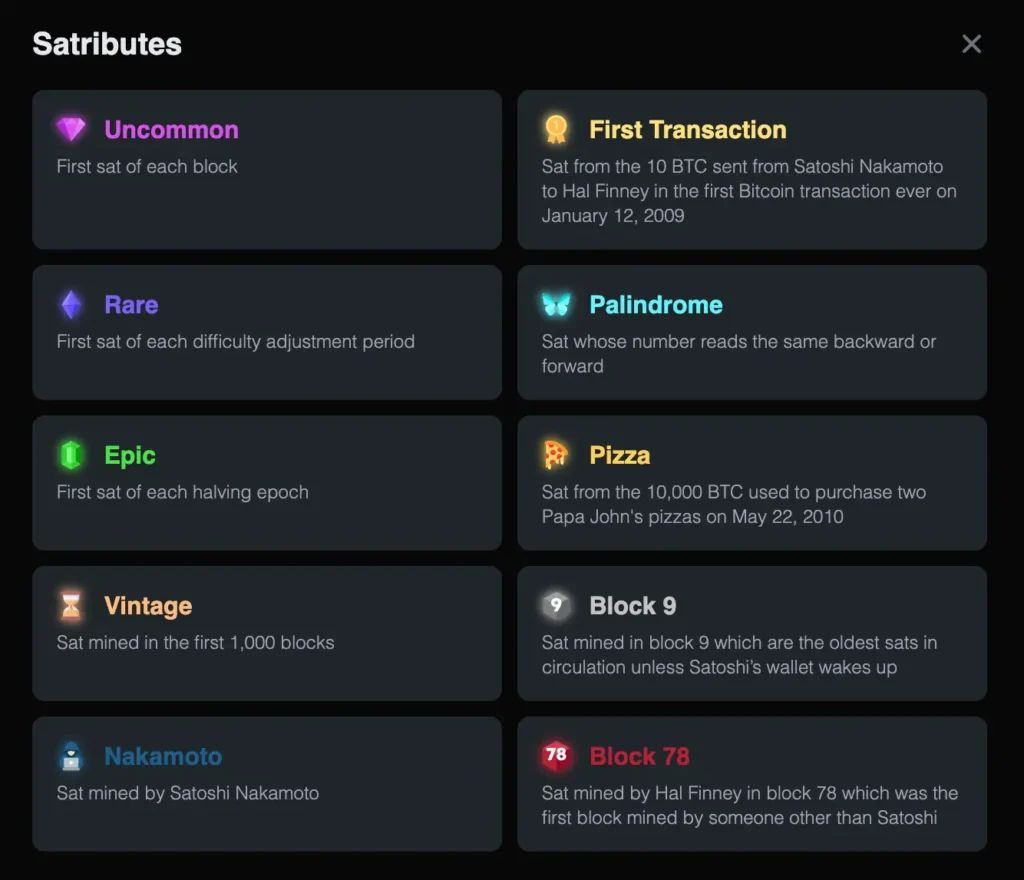

Different satoshis can have different attributes, or “satributes”

While this competition theory may sound outlandish, it’s perhaps not that far fetched after all. Sotheby’s auction house just sold a rare satoshi for over $150k AUD. The satoshi was unscribed and did not have any additional information attached, although the buyer can do so if they wish.

The valuation was due to the satoshi coming at a pivotal moment in Bitcoin network difficulty, meaning how hard it is to mine a bitcoin at a given moment.

So one billionth of a bitcoin was recently sold for 2.75 BTC!

It does indeed seem likely then that satoshis from the pivotal halving which comes at an all-time high, most likely on 20/04/2024, could sell for high prices and be coveted by miners to the point of reorganizing the blockchain in their favour.

Bitcoin Mining is About to Change

With the halving cutting down the rewards that miners receive for validating transactions and running the Bitcoin network, Bitcoin mining will become an increasingly competitive industry.

Mining income is about to be halved, and if BTC price doesn’t increase to compensate, the losses in the mining industry will be such that only the strong will survive. We’ll likely see mining operations revisit the way they approach mining from cutting costs on equipment and electricity to the type of updates they’ll be willing to vote in in the future.

It’s also likely that production hedging, where producers hedge their losses by short-selling their own commodity, will increase in popularity among miners, adding to growth in the Bitcoin derivatives market.

What to Expect After 2024 Halving

While crypto bulls always cite the halving as a major event that causes price appreciation, this claim is still up for debate. It’s true that each halving has preceded price increases in the past, and that the halving is designed to increase price, but whether the halving is the direct cause of these increases is another thing.

The above chart shows that the price increases after each halving have actually taken quite some time to kick in, and are therefore not necessarily directly correlated.

It’s always best to take any claims of price forecasting in crypto with a pinch of salt.

However, one thing is certain. We’re entering a new phase for the Bitcoin ecosystem, with markets within markets now emerging thanks to Bitcoin NFTs as well as unprecedented overhead costs for Bitcoin miners and record-breaking levels of adoption and international media attention on this growing industry.

The Bitcoin of today is not what the more streamlined digital gold invention that creator(s), Satoshi Nakamoto, perhaps envisioned, but a complex behemoth with many related markets acting as one, as the demand and use cases for cryptocurrencies continue to grow.