What is KYC Verification in Crypto?

KYC verification, short for Know Your Customer verification, has become a crucial process in the crypto industry. It involves verifying the identity of individuals or entities participating in cryptocurrency transactions to prevent illegal activities such as money laundering and terrorist financing.

In an increasingly digital world, KYC verification provides transparency and ensures the integrity of the crypto ecosystem. Understanding how it works, its benefits, and its challenges is essential for anyone involved in the crypto industry.

How Does KYC Verification Work?

KYC verification involves a series of steps to collect and verify user information. Typically, individuals are required to provide personal details such as their name, date of birth, address, and identification documents. This information is then verified against trusted sources to ensure its accuracy.

In some cases, additional documentation or proof of funds may be required. The process can be completed online or through manual review by compliance professionals. Once the verification is successful, users can proceed with their crypto transactions within the regulatory framework.

Benefits of KYC Verification

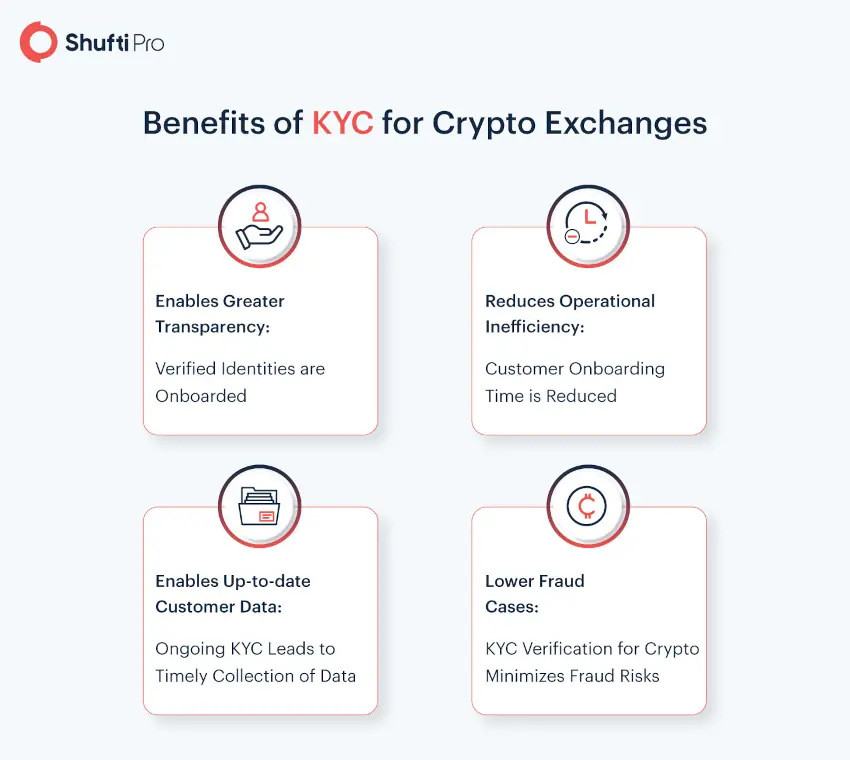

KYC verification offers several benefits to both the crypto industry and its participants. It helps create a more secure and trustworthy environment by preventing identity theft, fraud, and money laundering. By verifying user identities, businesses can ensure compliance with regulatory requirements, which enhances their credibility and reputation.

Additionally, KYC verification facilitates improved customer due diligence, risk assessment, and monitoring of suspicious activities. Overall, KYC verification promotes transparency and integrity within the crypto ecosystem.

Challenges of KYC Verification in the Crypto Industry

KYC verification in the crypto industry faces several challenges. One of the major obstacles is the need to balance security with user experience. Striking a balance between strict verification processes and a smooth onboarding experience can be challenging.

Additionally, the decentralized nature of cryptocurrencies poses difficulties in establishing a single source of truth for identity verification. There are also concerns regarding data privacy and protection, as storing sensitive customer information can attract malicious actors.

KYC Verification Best Practices

KYC verification best practices involve implementing efficient and secure processes to ensure compliance and protect customer data.

These practices include adopting automated verification solutions, conducting thorough customer due diligence, maintaining strong data security measures, regularly updating and reviewing compliance policies, and collaborating with reliable third-party service providers.

By following these best practices, businesses in the crypto industry can enhance their KYC verification procedures and mitigate potential risks associated with fraud and identity theft.

Final Thoughts

In conclusion, KYC verification is a crucial process in the crypto industry that helps ensure regulatory compliance and protect against fraud and identity theft.

By implementing best practices such as automated verification solutions, thorough customer due diligence, strong data security measures, and collaboration with reliable third-party service providers, businesses can effectively streamline their KYC procedures. These measures enhance trust and security in the industry, contributing to its overall growth and legitimacy.

Frequently Asked Questions about KYC Verification in Crypto

What is KYC verification in the crypto industry?

KYC verification is a process that involves verifying the identity of individuals or businesses participating in cryptocurrency transactions, ensuring compliance with regulatory requirements.

Why is KYC verification important in the crypto industry?

KYC verification helps prevent fraud, money laundering, and other illicit activities by establishing the identities of users and ensuring transparency within the crypto ecosystem.

How does KYC verification work?

KYC verification typically involves users submitting identification documents and proof of address to cryptocurrency exchanges or platforms to validate their identities.

What are the benefits of implementing KYC verification?

The benefits of KYC verification include enhanced security for users, reduced risks of fraud and scams, improved trust within the crypto industry, and regulatory compliance.

What are some challenges of KYC verification in the crypto industry?

Challenges include potential privacy concerns, data breaches, lengthy verification processes, and global regulatory variations that may pose difficulties for international transactions.

What are best practices for conducting KYC verifications in crypto?

Best practices include implementing automated verification solutions, conducting thorough customer due diligence, ensuring strong data security measures, and collaborating with reliable third-party service providers.

Can anyone bypass KYC verification in crypto?

No, KYC verification is a mandatory requirement imposed by regulatory bodies on cryptocurrency exchanges and platforms to prevent illicit activities and ensure compliance with anti-money laundering (AML) regulations.

Is KYC information stored securely?

Yes, reputable service providers employ strict security measures such as encryption protocols and secure storage systems to protect user information from unauthorized access or cyber threats.

Can I use a pseudonym or alias during KYC verification in crypto?

No, KYC requires users to provide valid identification documents that match their true identities. The use of pseudonyms or aliases is not allowed as it undermines the purpose of verifying user identities.

What happens if I fail KYC verification?

Failure to pass the KYC verification process may result in limited access to certain platforms or services within the crypto industry, as non-compliance with regulatory requirements can lead to legal consequences.