How Much Crypto Do Australian Investors Own?

Australia has seen a significant rise in crypto ownership, with a growing number of individuals embracing digital currencies. Factors such as increased awareness, accessibility, and the potential for high returns have contributed to this trend.

Grineo collaborated with a consulting agency to conduct original research into the Australian crypto market, granting us invaluable insights into the digital assets landscape.

Introduction to Crypto in Australia

Cryptocurrency is increasingly popular in Australia, with recent surveys showing that between 18% and 25% of Australians now own some form of digital currency. This makes Australia one of the global leaders in cryptocurrency adoption.

Regulations in Australia are well-defined, ensuring that the use of digital currencies is both safe and transparent, guided by organizations like the Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO).

As the startup scene in Australia pushes the boundaries of blockchain technology, the country is becoming a key player in digital finance. With such a significant portion of the population now involved in the crypto market, it raises the question: how much cryptocurrency does the average Australian investor actually own?

This growing interest not only highlights the expanding role of digital currencies in everyday financial activities but also underscores the robust regulatory and innovative environment that supports its growth.

Crypto Ownership Statistics in Australia

According to our findings, the 25 to 34 age group is the most active in cryptocurrency investments. Over 10% of respondents in this age bracket are involved in the crypto market, making up 36% of the total investor base. This suggests that younger adults, possibly due to their familiarity with technology and openness to new financial tools, are the most enthusiastic about exploring the potentials of digital currencies.

Following closely are the younger 18 to 24 age group and the slightly older 35 to 49 cohort, who represent 28% and 23% of crypto investors, respectively. These statistics highlight a trend where the majority of cryptocurrency investors are under the age of 50, indicating a generational shift in investment preferences towards more digital and tech-focused assets.

These statistics reveal a trend: the majority of cryptocurrency investors are under 50, showing a shift toward digital and tech-focused assets among younger generations. This reflects broader changes in how people choose to invest, with a move away from traditional investments to more innovative, digital options.

How Much Does the Average Crypto Holder Own in Australia?

Among people who own crypto in Australia, the average crypto portfolio value is $56,000 AUD. 60% of Australian crypto investors are under 35 years of age.

Our figures align with a separate study carried out by the Roy Morgan institute, albeit with a lesser gap between younger and older investors.

Individuals aged 18 to 24 boast an average portfolio size of approximately A$14,000, while those in the 25-34 and 35-49 age brackets have A$37,000 and A$39,000 invested in cryptocurrencies respectively.

While the average portfolio value is $56,000, this can be somewhat skewed by those with major investments. The Australian Securities Exchange found in 2023 that the median amount that crypto holders own is $5,100. However, the median portfolio size including non-crypto assets was $170,000.

Combined, these figures help paint a more detailed picture of the market for cryptocurrencies in Australia.

Total Crypto Investment in Australia

It’s worth noting that Grineo found that Australian investors account for 1.22% of the total crypto market cap despite Australia having only 0.32% of the world’s population, signalling a major and growing appetite for digital assets in Australia.

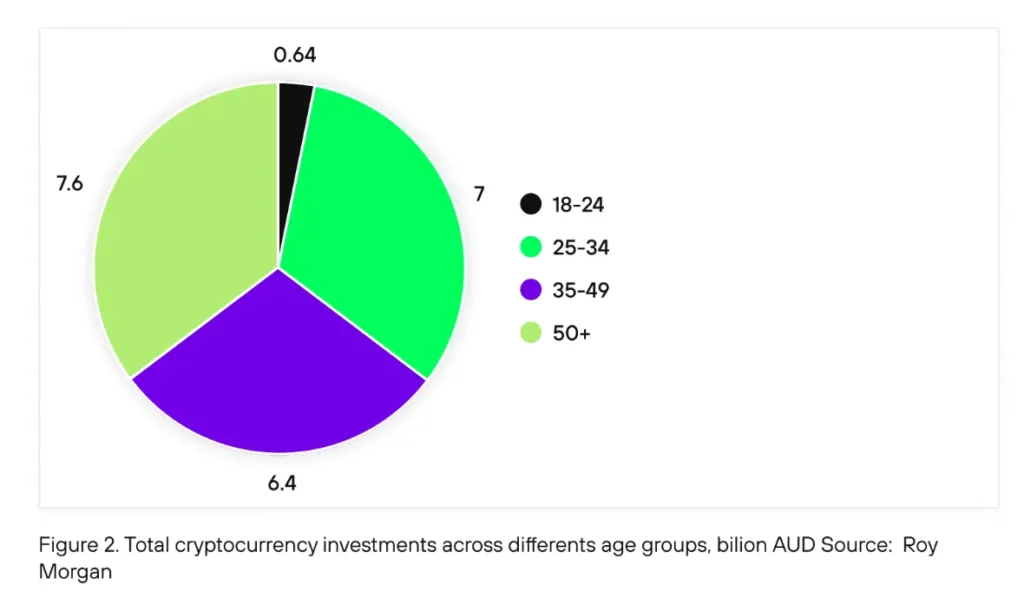

Figure 2. Total cryptocurrency investments across different age groups, billion AUD

Source: Roy Morgan

The collective sum of digital assets investments across all age brackets amounts to A$21.36 billion, translating to $14.2 billion or 1.22% of the total cryptocurrency market worldwide.

Like most demographics, Australians favour Bitcoin with 65% of Australian crypto investors holding the OG cryptocurrency. The next most popular coins are Ethereum, Cardano, Dogecoin, and Binance Coin.

What’s Next for Australian Crypto Investors?

The survey we commissioned indicated that despite the high penetration of cryptocurrency in Australia, the range of use cases is limited. In fact, more than half of the audience uses cryptocurrency only as an investment and keeps cryptocurrency on average for a year.

The Grineo card was created to help bring more adoption to the world of digital assets, allowing users to spend stablecoins on real-world goods and services. Our card is issued by Visa, and supported anywhere that Visa cards are accepted. You can use it to spend digital assets or even withdraw them as cash from almost any ATM in the world, bringing much-needed adoption to the industry.