Not Your Average Bitcoin Halving: Here’s What Happens Next

The Bitcoin halving is one of the most highly-anticipated events in crypto, occurring once every four years. The halving is often associated with higher BTC prices – but is that still to be expected in this day and age?

In this article, we will delve into what the Bitcoin Halving is, explore its historical context, and discuss the potential implications for the future of Bitcoin and the cryptocurrency market at large.

Table of Contents

- Bitcoin Halving History: Context for the Halving

- Macroeconomic Factors for 2024 Bitcoin Halving

- Rising Electricity Prices for Miners

- Bitcoin Price Maturation in 2024

- Global Inflation and Bitcoin in 2024

- International Tensions and Conflicts

- Interest Rates: How Do Rate Hikes Affect Bitcoin Halving?

- Bitcoin Ordinals and the BTC Halving

- Final Thoughts

Bitcoin Halving History: Context for the Halving

4th halving 2024-04-20 00:09 UTC 63,976.64 pic.twitter.com/VJCFHWXPHu

— ChartsBTC (@ChartsBtc) April 20, 2024

Bitcoin is produced by miners who use specialized computers to solve cryptographic puzzles, with the winner minting new bitcoins as their reward. Miners then sell these bitcoins or store them for sale later on. This is called proof-of-work mining, and every time miners solve a puzzle, they enter a new block of transactions to the Bitcoin ledger, thus maintaining the network.

Bitcoin has a built-in mechanism called the halving, where the reward miners receive is cut in half every four years. The halving is designed to increase scarcity and deflation, a response to the inflation seen in fiat money like the Australian dollar.

Previous halvings in 2012, 2016, and 2020 have been landmark events, each uniquely influencing the cryptocurrency’s price and the mining ecosystem.

Historically, these events led to significant price increases and shifts in mining activity. The common pattern observed suggests a potential initial drop in miner profitability due to the reward halving, which is often followed by a gradual increase in Bitcoin’s price as the reduced supply hits the market.

Macroeconomic Factors for 2024 Bitcoin Halving

The macroeconomic climate for Bitcoin is different for this latest halving, with unprecedented conditions now at play.

Let’s take a look at the different geopolitical and economic factors that might impact the way the halving and BTC price interact.

Rising Electricity Prices for Miners

While in Australia, electricity prices have fallen recently, this is not the case worldwide.

The US, which accounts for over 40% of Bitcoin mining, has seen year-over-year increases in the cost of electricity, increasing the overhead costs for miners. The cost of 1 kw/h rose on average 6.2% last year from 15.04 cents to 15.98 cents USD and has continued this trend throughout early 2024. The increase is due to a number of factors including global conflicts impacting supply/demand dynamics for energy providers worldwide due to sanctions restricting the market and supply chains being disrupted.

Because Bitcoin mining uses a huge amount of electricity, the cost of electricity is the main overhead for miners, with equipment and facility maintenance coming afterwards.

This rise in electricity cost may cause a shift in mining activities to regions with cheaper electricity. Bitcoin fees skyrocketed after the halving to $173 USD per priority transaction and have remained high in the following days, meaning that for the time being, miners are still making profits off of mining.

Bitcoin Price Maturation in 2024

Bitcoin price maturation is a major factor in the impact of the halving. While previous halvings appeared to correlate with major price increases in the weeks or months after BTC supply was halved, those events took place at a time when Bitcoin was a far more niche asset.

Much has changed in the last four years, with Bitcoin now the eight largest asset class in the world, surpassing silver in March 2024.

With every trader and asset broker in the world now familiar with Bitcoin, it’s safe to say that the halving may have been priced into the market, meaning that the market anticipated the halving ahead of time and adjusted prices accordingly. An asset becomes priced in due to the majority of market participants betting on its behaviour ahead of time.

As such, traders may have decided that Bitcoin was going to increase due to the halving months ago and bought in, causing prices to rise. Bitcoin did indeed hit an all-time high before the halving, meaning that the impact of the halving may have actually happened ahead of time.

Some analysts now feel that there is no reason to expect a subsequent price increase related to the halving, although of course the market is impossible to accurately predict. There are many other factors that impact Bitcoin price beyond the halving, such as inflation.

Global Inflation and Bitcoin in 2024

Inflation has, of course, significantly increased following the COVID-19 epidemic that took hold of the world around the time of the last halving in 2024. World banks printed off a lot of extra money to help stimulate the economy which drastically slowed due to businesses being shut down during quarantine.

Supply chains of goods were also broken with factories, businesses, and even borders being closed to commerce.

All of these factors have caused an increase in the price of many goods, services, and assets. There has long been debate over whether Bitcoin is being used as a safe haven from inflation and stock market corrections, and the jury is still out in this regard. However, it’s possible that higher inflation in cash does or will lead to people seeking to hedge cash losses by investing in Bitcoin instead, thus raising the price of Bitcoin.

With Bitcoin now becoming a scarcer asset after the halving, it’s possible that demand will increase. However, with BTC fees still so high after the halving it is difficult to say what the long-term impact will be.

International Tensions and Conflicts

Bitcoin might see increased demand in nations experiencing conflict or financial instability, serving as a decentralized alternative to unstable local currencies. There are now more than 110 armed conflicts being reported around the world.

As geopolitical tensions and armed conflicts disrupt traditional economic structures and instabilities in local currencies arise, cryptocurrencies such as Bitcoin present themselves as viable alternatives for several reasons:

- Decentralization: Unlike traditional currencies, which are issued and regulated by central authorities such as governments and central banks, Bitcoin operates on a decentralized network. This means it is not subject to the same kinds of political or economic manipulations or the direct impacts of local economic crises, making it an attractive option for individuals in unstable regions.

- Ease of Transfer: Bitcoin can be transferred quickly and securely across borders without the need for intermediaries like traditional banks or financial services, which often impose fees and can delay transactions.

This capability is particularly valuable in global commerce and remittances, where parties seek efficiency and minimal transaction costs. Bitcoin transactions are conducted on a peer-to-peer basis, ensuring that users can send and receive payments directly from any part of the world with internet access, enhancing its utility for international trade and personal transfers alike.

- Privacy and Security: Bitcoin provides a level of privacy and security unmatched by conventional financial systems. Transactions are pseudonymous, as they do not directly reveal the identity of the parties involved, although they are still traceable through blockchain analysis.

Furthermore, the Bitcoin network employs robust cryptographic techniques to secure transaction data, reducing the risk of fraud and theft. This security aspect is crucial for users who prioritize confidentiality and safety in their financial dealings.

These features underline the growing appeal of Bitcoin as an alternative to traditional financial systems, especially in a digitally connected and globalized economy.

Institutional Involvement and Regulation in Bitcoin in 2024

The max supply for Bitcoin is 21 million, meaning only 21 million bitcoins will ever be mined. The last bitcoin will be mined in about 100 years.

Currently, major banks own about one million bitcoins, and crypto exchanges hold about 2.3 million. 2.4 million are thought to be lost forever, and around 1.4 million remained to be mined.

So institutional investors own a significant portion of the supply. Increased crypto adoption by major banks could lead to more stable investments and potentially less volatility post-halving. As banks become involved, the pressure for regulation increases.

Bitcoin has historically been unregulated, but governments are wary of allowing banks and banking customers to be involved in unregulated assets.

Regulatory developments in key markets like the US, EU, and Asia could influence Bitcoin’s adoption rate and market dynamics.

For example, Bitcoin ETFs or exchange-traded funds have recently been introduced to the market.

An ETF allows people to invest in the price action of Bitcoin without actually buying Bitcoin directly. Instead, they buy derivatives through a bank or exchange.

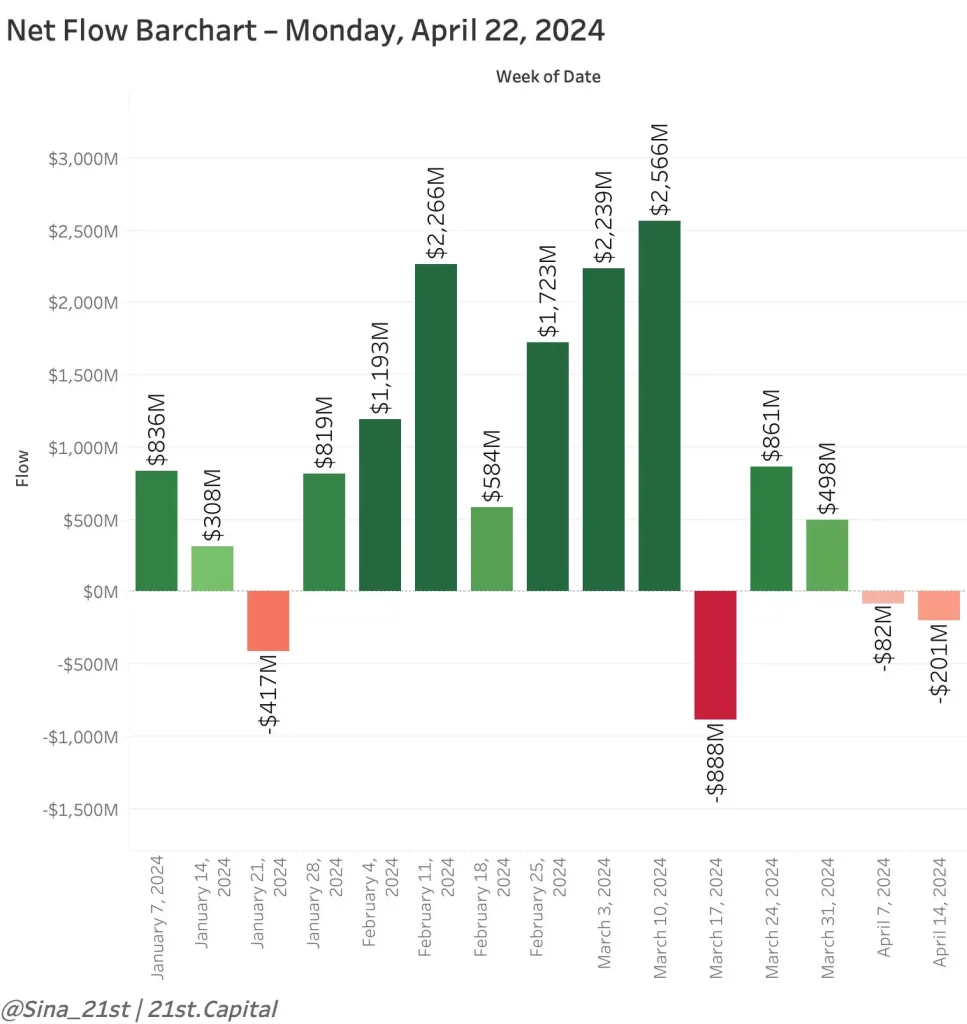

The above chart shows two weeks of net outflows for Bitcoin funds, meaning people have been withdrawing their money, a bearish sentiment that indicates they are not confident in BTC price increasing.

ETFs increase accessibility to Bitcoin, another possible way for the halving to be priced in. More liquidity may mean less volatility and more stable prices, possibly curbing the meteoric growth seen to date in the Bitcoin lifecycle.

It’s also interesting to note that ETFs may cause a disconnect between Bitcoin holders and Bitcoin voters, as miners who decide on Bitcoin network updates may have less voting power due to a decreased ownership of the Bitcoin supply. The effect of this remains to be seen.

Interest Rates: How Do Rate Hikes Affect Bitcoin Halving?

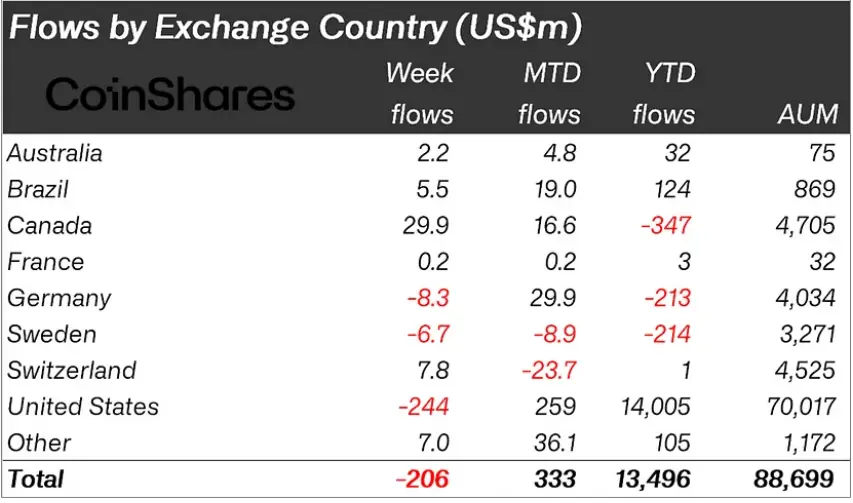

The outflows shown in the chart in the previous section were mostly from US investors.

Source: CoinShares

It’s possible that US investors are feeling bearish on Bitcoin because they expect that the Federal Reserve bank will maintain elevated interest rates for longer than expected. The Fed has been keeping interest rates high to make borrowing money more expensive in an effort to combat inflation.

High rates also attract foreign investors seeking high returns on their investments, strengthening the US dollar. Fed Chairman Jerome Powell stated in mid-April that rates may remain higher, and this can lead to economic uncertainty including investors cashing out BTC in case of a crash.

Bitcoin Ordinals and the BTC Halving

A final factor to note is the introduction of Bitcoin Ordinals. One bitcoin is comprised of 1 million satoshis, the smallest measurable sum of BTC. Satoshis are now being sold as non-fungible tokens (NFTs), expanding the Bitcoin derivatives market far beyond anything we’ve seen before.

Satoshis from rare or unusual moments in Bitcoin mining, such as the halving, are now potentially worth far more to collectors than the actual market value they represent, meaning someone could buy one millionth of a particular Bitcoin at a marked up price.

This new development in the market could also throw off previous BTC price models created by analysts, making the future even more difficult to estimate.

Final Thoughts

The Bitcoin halving is always a critical event. Now that it’s happened, we’ve seen major outflows from Bitcoin exchanges, a bearish signal. Bitcoin prices have remained stable near an all-time high that may have been priced in.

High interest rates are perhaps causing investors to be cautious when it comes to higher-risk investments like Bitcoin, which remains volatile. However, volatility may also reduce in the coming months and years due to more market participants buying Bitcoin than ever before.

As you can see, Bitcoin price action is a complex dance involving many different factors. It’s possible that the halving will not have the same meteoric price impact as in previous years, although of course, all we can do for now is keep an eye on the charts and see what happens next.

You can store Bitcoin and other digital assets on Grineo and even spend stablecoins like cash using the Grineo Card.